Tailings Dam Monitoring with InSAR & AI

Tailings Dam Monitoring: How Advanced Satellite Intelligence Is Transforming Tailings Dam Safety Tailings dams are among the most critical—and high-risk—structures

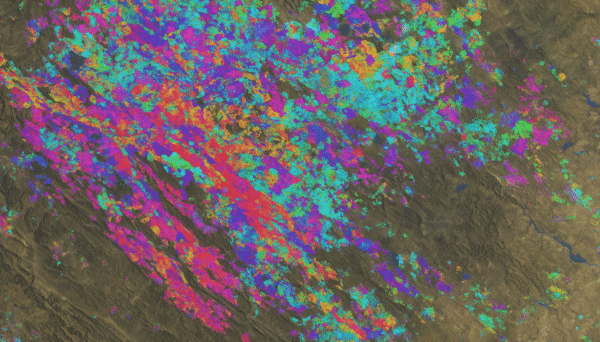

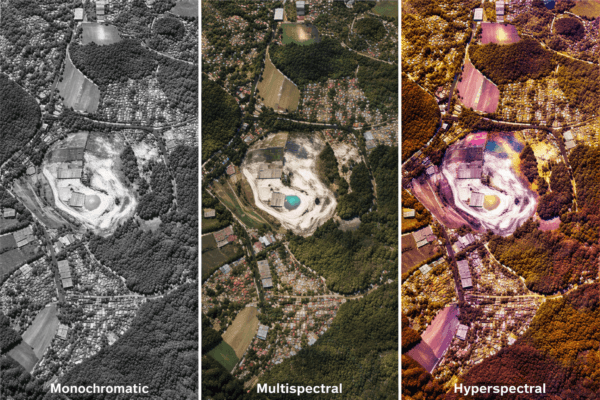

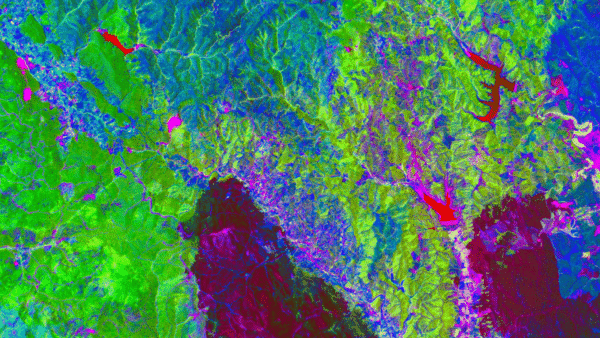

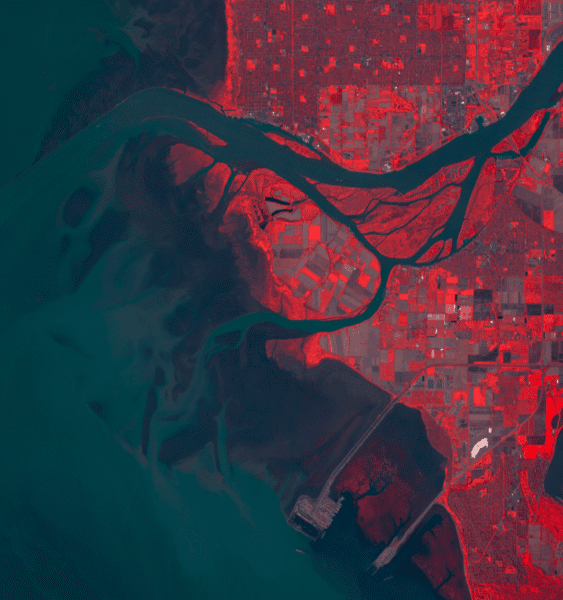

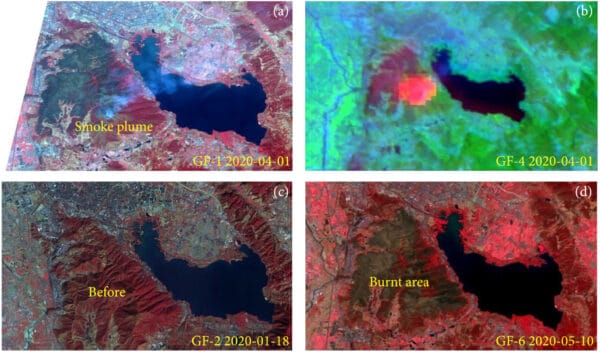

The global geospatial intelligence market is changing fast. For years, satellite imagery meant “pictures from space.” Useful, yes — but limited. Today, the most valuable Earth Observation (EO) programs are moving into spectral intelligence, where pixels carry measurable information about materials, chemistry, and subtle environmental shifts.

In this new landscape, two names frequently appear in hyperspectral conversations: XRTech Group (in partnership with China Siwei) and the Canadian company Wyvern. On the surface, both offer hyperspectral data. But their approach is fundamentally different:

XRTech Group is a full-spectrum geospatial ecosystem: optical, SAR, hyperspectral, AI platforms, and even 5G-connected drone operations.

Wyvern is a hyperspectral specialist: a focused constellation built for hyperspectral imaging at scale.

So which is “better”?

The honest answer is: it depends on what your mission requires. But for most enterprise and government programs, “better” is less about brand and more about whether your provider can deliver the right sensor mix, the right spectral capability, the right resolution, and the right operational speed — without forcing you to compromise.

This guide breaks down both providers across business model, constellation scale, hyperspectral performance, AI platforms, pricing realities, export constraints, and real-world use cases. By the end, you’ll be able to choose based on objective requirements instead of marketing slogans.

When people compare satellite providers, they often focus on one number: resolution. But that’s a trap.

A “better” imagery provider is the one that reliably helps you answer your operational question:

Are you trying to identify a mineral composition?

Are you trying to detect deformation in a pipeline corridor under clouds?

Are you monitoring a region where tasking must happen multiple times per day?

Do you need ground truth validation from drones?

Is your team a research group that wants clean VNIR data with strong calibration and an open-data pipeline?

Wyvern is designed to help you extract insight from high-resolution hyperspectral VNIR data.

XRTech is designed to help you run industrial-scale geospatial operations, where hyperspectral is part of a broader stack that also includes 30 cm optical, SAR, and value-added engineering outputs, with the added advantage of drone synergy.

So before comparing them technically, we need to compare how they’re built as businesses.

XRTech Group’s model is built around being a global distributor and solution provider, leveraging China Siwei’s multi-decade EO infrastructure. Instead of offering one sensor type, XRTech functions as a complete geospatial shop: satellite tasking, archives, AI modeling, and integration with ground and aerial systems.

The most practical benefit of this model is flexibility. If your problem needs hyperspectral today, optical tomorrow, and SAR next week due to cloud cover, you don’t need to rebuild your procurement pipeline. XRTech’s ecosystem is designed for multi-sensor fusion, which is increasingly how serious programs operate.

XRTech also positions itself around “mission delivery,” not just data. This shows up in how they talk about engineering-grade outputs (DEM/DSM/DOM), digital twins, and InSAR analytics for millimeter-scale deformation — all of which are usually demanded by governments, utilities, energy operators, and large mining groups.

Wyvern’s business model is the opposite. They launched the world’s first commercial hyperspectral satellites in 2023, and they focus tightly on making hyperspectral data accessible and easy to use. Their product philosophy centers on “spectral intelligence” and analysis-readiness: research-grade calibration, atmospheric correction, and developer resources such as a hyperspectral index library.

Wyvern is not trying to be a multi-sensor provider. They’re trying to be the hyperspectral provider you use when hyperspectral is the core of your work — especially when spatial detail matters within the VNIR spectrum.

That makes Wyvern very attractive to research teams, developers, and application builders who want consistent hyperspectral data without needing to navigate a large multi-sensor supply chain.

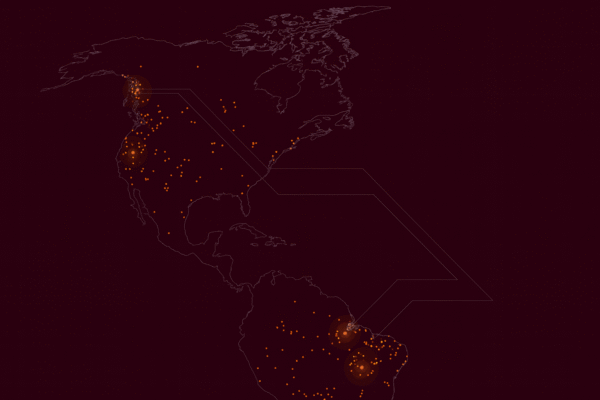

XRTech’s greatest advantage is scale. With access to over 130 civilian and commercial satellites, the practical result is not “more satellites” as a vanity metric — it’s operational resilience:

More opportunities to collect imagery across time windows

Better coverage for large AOIs

Faster response for urgent tasking

Availability across optical and SAR regardless of weather

A key part of XRTech’s ecosystem is the SuperView Neo system, which includes 28 satellites, broken down into VHR optical, wide-swath, and SAR.

The operational story here matters. SuperView Neo’s revisit capacity is described as up to 25 times per day, with daily coverage reaching massive area scales. For dynamic monitoring missions — border monitoring, fast-evolving disasters, rapidly changing mining operations — this revisit capability changes what is possible.

XRTech also highlights global command upload within ~3 hours through 10+ ground stations. That matters for mission scheduling, because tasking is not just about having satellites — it’s also about being able to command them, ingest data, and deliver outputs at speed.

Wyvern operates a smaller constellation, built for a specific purpose: high-resolution hyperspectral at scale. A smaller constellation doesn’t automatically mean “worse.” It means the provider has made a design decision: optimize around a single data type and its workflow.

Wyvern emphasizes flexible tasking and a growing archive, including an open data program that helps teams test and build applications. For many buyers, this is valuable because hyperspectral work often starts in R&D. Having easier access for experimentation can shorten adoption cycles.

The difference is this:

XRTech is built to handle complex missions with many constraints.

Wyvern is built to make hyperspectral more usable and scalable for hyperspectral-first projects.

This is where most comparisons get interesting — and where a lot of marketing becomes misleading if you don’t understand what the specs mean.

Hyperspectral imagery is about chemical and material fingerprinting. But not all hyperspectral sensors are equal.

Wyvern leads in hyperspectral spatial resolution in the commercial market: 5.3 meters GSD at nadir.

This matters because many hyperspectral systems historically operate at coarser spatial resolution (often around 30 meters). At 30m, each pixel mixes multiple ground features. At 5.3m, you can isolate smaller features more reliably.

That means Wyvern can be especially strong when you need to see where changes are happening with better spatial clarity: crop patterns, field-level variation, localized environmental shifts, and site changes that might disappear in coarse pixels.

If your use case depends on tighter spatial discrimination inside VNIR, Wyvern’s 5.3m is a real advantage.

XRTech’s hyperspectral advantage is different and in many missions, more decisive: spectral depth and range.

The GF-5B satellite is described with a spectral range of 400–2500 nm, spanning:

Visible

Near-infrared (VNIR)

Short-wave infrared (SWIR)

It also features an advanced hyperspectral imager with ~330 spectral bands (or 318 in earlier versions).

This is not a small difference.

Wyvern’s current technology is described as 31-band VNIR imagery. XRTech’s GF-5B extends deep into SWIR, which is where many critical mineral and chemical absorption features become visible.

So here’s the cleanest way to understand the tradeoff:

Wyvern is better at identifying where material shifts occur at high spatial resolution in VNIR.

XRTech is better at determining what those materials are, because SWIR + 330 bands enable more confident chemical and mineral identification.

In mining, geology, and environmental contamination monitoring, the SWIR region often matters more than people realize. Many minerals and hydrocarbon-related materials show stronger diagnostic features in SWIR. If your mission is “mineral fingerprinting,” the band depth and SWIR coverage are not just technical bragging rights — they can directly determine whether your detection is defensible.

Technology is not just sensors anymore. The value increasingly comes from what your provider helps you do with the data.

XRTech’s proprietary AI ecosystem Khaza’in is built specifically for mineral discovery. The key promise is speed: using deep learning to match hyperspectral patterns with known mineral signatures, turning early-stage targeting from multi-year workflows into something far faster.

The Tanzania Lake Victoria Gold Belt is important because it represents what enterprise mining teams actually want: fewer blind exploration campaigns and faster prioritization of targets with supporting evidence.

The Mauritania example (10 priority zones with probability estimates) also signals something else: XRTech’s workflow isn’t “just deliver data.” It’s: deliver data + interpretation + prioritization logic that reduces decision time.

If your hyperspectral program is meant to drive operational mining decisions, platforms like Khaza’in can become a major differentiator.

Wyvern’s focus is “analysis readiness.” Their emphasis on research-grade calibration and atmospheric correction helps ensure data behaves consistently — critical for scientific work, model training, and developer workflows.

They also strengthen adoption through:

knowledge resources

hyperspectral index libraries

tutorials and developer content

partner ecosystem for specific applications (fertilizer optimization, tree species detection)

This model is powerful for organizations building internal capability. If your team wants clean data to feed into your own models, Wyvern’s approach reduces friction.

So again, the difference is clear:

XRTech’s advantage is speed-to-mining-targeting outcomes through an AI platform built for mineral discovery.

Wyvern’s advantage is analysis-ready hyperspectral VNIR data with strong calibration and developer enablement.

Mining is not one workflow — it’s a chain: exploration, feasibility, operations, compliance, closure, rehabilitation.

XRTech tends to win early-stage mineral targeting because of the 330-band hyperspectral depth and SWIR coverage and the Khaza’in platform. That combination is built for identifying mineral signatures like gold-associated alteration zones, copper, lithium-related clays, and other surface-visible indicators.

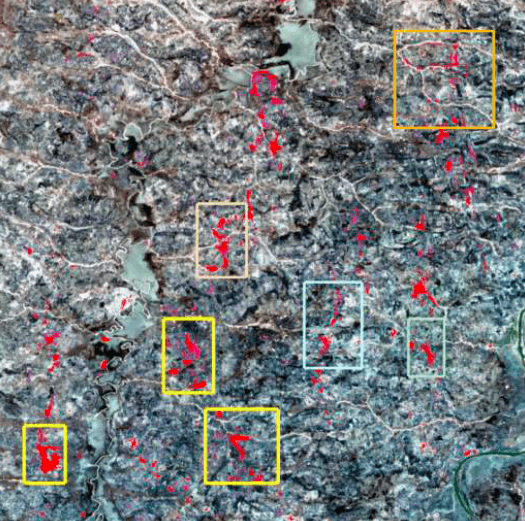

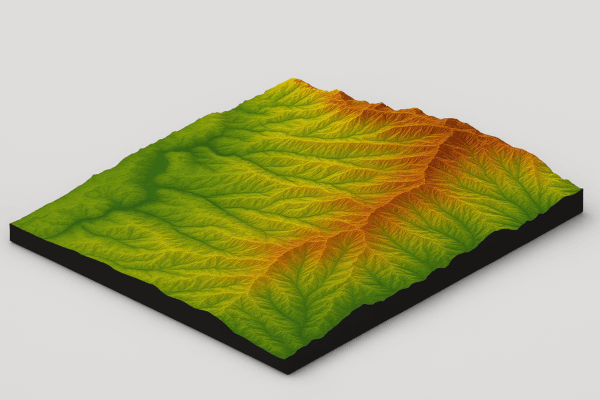

XRTech also has a major advantage through SAR and InSAR capability. Tailings dam monitoring and ground deformation tracking are not optional anymore for serious operators. InSAR accuracy at 1–2mm scale changes how risk teams manage stability and compliance.

Wyvern tends to be strong in monitoring phases where spatial hyperspectral detail matters: reclamation monitoring, environmental shifts, and safety-related change detection. For post-closure rehabilitation, the ability to track vegetation regrowth patterns and subtle land changes at higher hyperspectral spatial resolution is valuable — especially when teams need ongoing proof of restoration progress.

In simple terms:

If the mission is “find mineral targets faster and reduce uncertainty,” XRTech is often the better fit.

If the mission is “monitor surface change and environmental shifts with higher hyperspectral spatial detail,” Wyvern becomes very attractive.

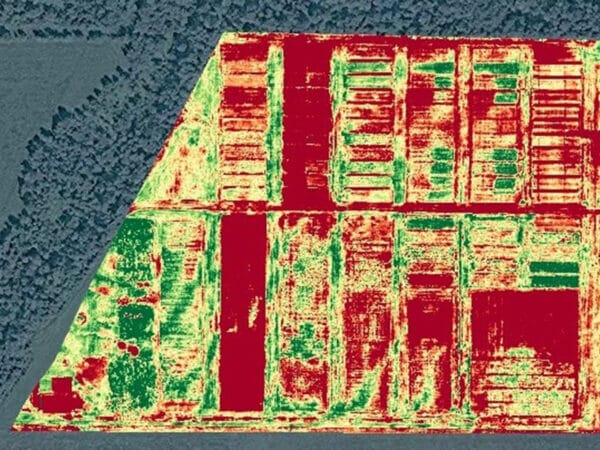

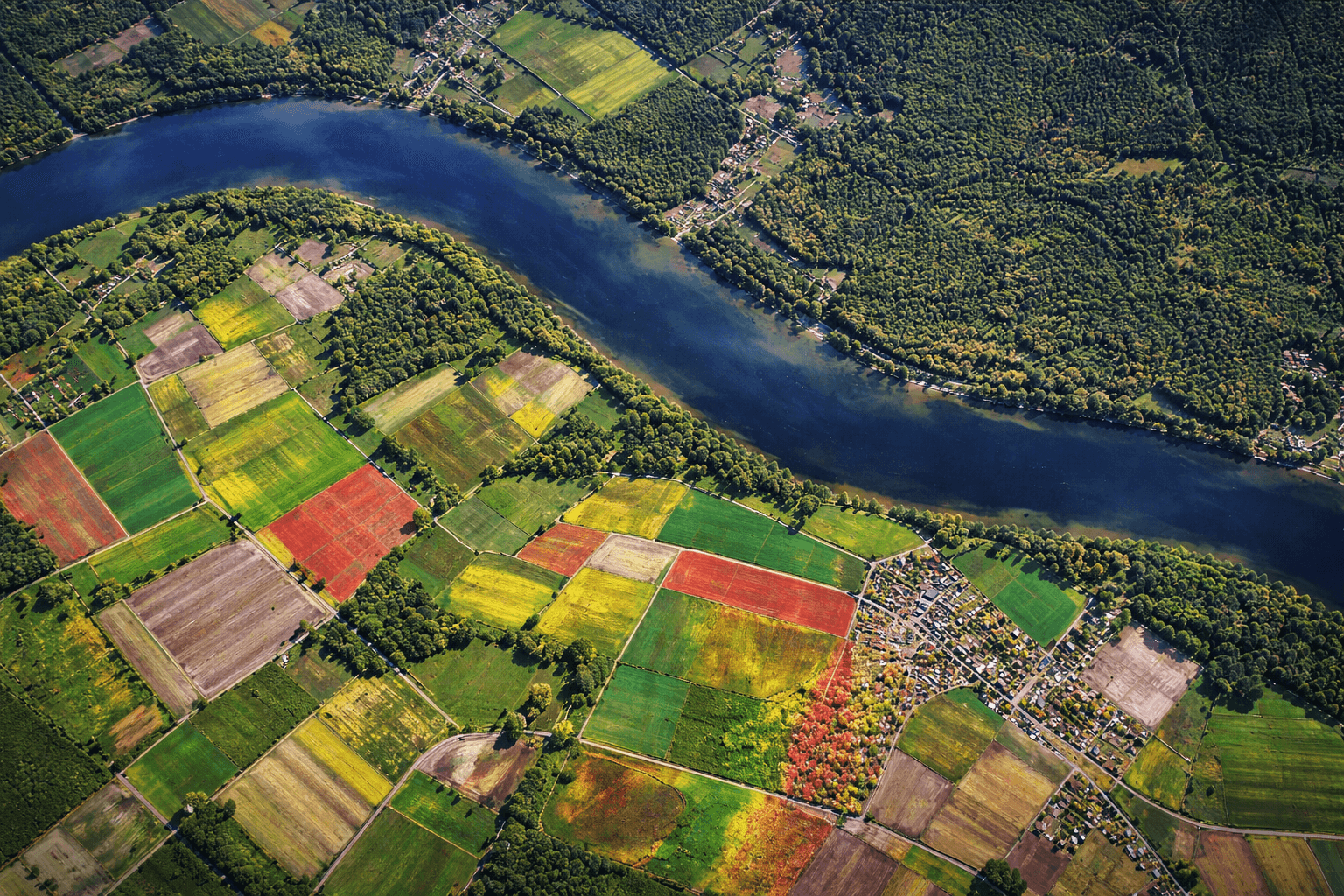

Agriculture is where Wyvern’s 5.3m hyperspectral can shine because hyperspectral at that resolution moves closer to “field actionable.”

XRTech’s strength in agriculture comes from scale and frequency. With broad optical coverage, indices like NDVI and NDRE, and AI models for crop classification and yield estimation, XRTech supports program-level monitoring across large regions, especially when you need frequent revisits and consistent coverage.

Wyvern’s strength is more about subtle spectral shifts at higher resolution within VNIR, enabling earlier detection of disease stress or nutrient imbalances — particularly where coarse hyperspectral would blend signals.

This leads to a practical decision:

If you need monitoring across huge areas at operational cadence with multiple sensor types, XRTech is better.

If you need hyperspectral-driven agronomy insight where spatial detail is critical, Wyvern is better.

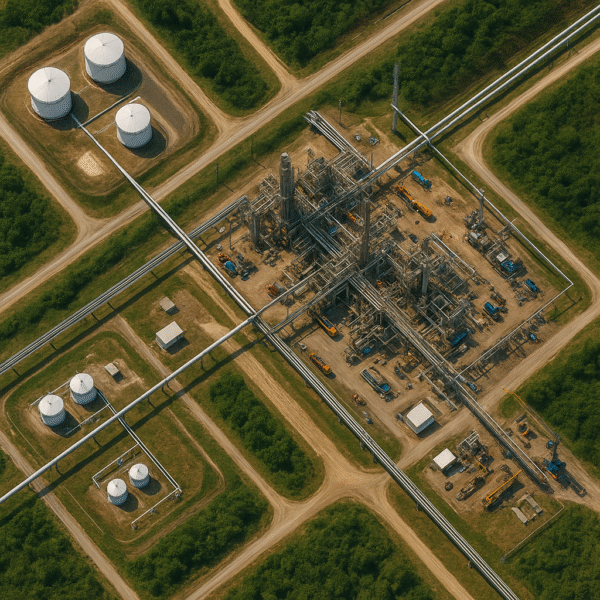

XRTech is a clear leader when the mission includes infrastructure deformation monitoring. InSAR capability is built for pipeline corridor deformation, subsidence, and stability monitoring. The floating-roof tank crude inventory measurement example is also the kind of operational intelligence enterprise energy teams care about.

Wyvern’s strength in energy is more aligned with spectral monitoring for environmental impact and resource mapping. Hyperspectral can support remediation tracking and surface condition assessment — but without SAR, Wyvern cannot compete in all-weather deformation monitoring.

So for energy and critical infrastructure:

If the mission requires day/night, all-weather monitoring and deformation detection, XRTech wins.

If the mission is environmental monitoring and spectral change detection where VNIR insight is sufficient, Wyvern can still play a role.

This is one of the most underappreciated differentiators, and it matters because it changes validation and operational workflows.

Satellites give you scale. Drones give you detail.

XRTech’s ability to combine both is more than a “nice to have.” It closes the gap between remote sensing outputs and actionable site reality.

“Drone-in-a-box” systems such as automated docking stations allow unmanned operations — drones can deploy, land, and recharge without human intervention. This enables persistent inspection workflows.

But the most strategic advantage is ground-truth calibration. Hyperspectral interpretations are strongest when they are validated against samples or close-range sensing. Drone-based data can calibrate and validate satellite models, improving confidence, reducing false positives, and strengthening reporting defensibility.

In high-security or critical infrastructure environments, this orbital-to-aerial chain supports both strategic overview and tactical inspection. That combination is extremely hard for a hyperspectral-only provider to replicate.

Here’s the technical comparison in the language buyers care about. Not just numbers — what they mean.

XRTech Group

Best spatial resolution: 30cm optical (e.g., SuperView Neo-1), 40cm (SuperView-2)

Hyperspectral: 30m class hyperspectral with GF-5B

Spectral range: 400–2500 nm (VNIR + SWIR)

Hyperspectral band depth: ~330 bands

SAR: yes (C-band 1m class, L-band ~3m class depending on constellation)

Archive: long history (since 1999 according to your notes)

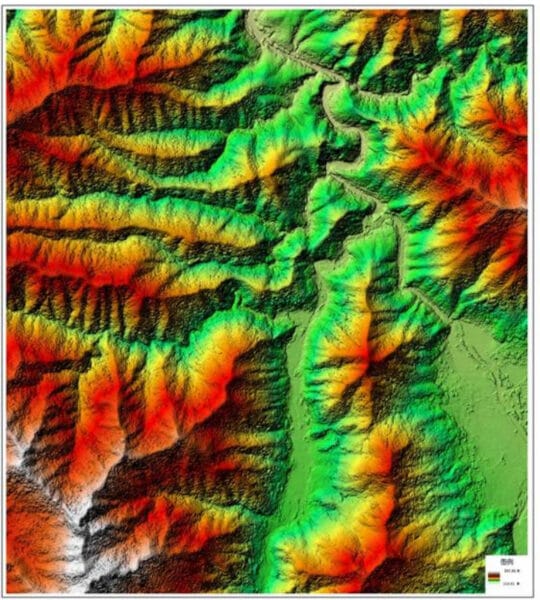

Outputs: DEM/DSM/DOM, InSAR analytics, digital twins

Wyvern

Hyperspectral spatial resolution: 5.3m at nadir

Spectral range: VNIR-focused

Spectral bands: ~31 bands VNIR

SAR: no

Archive: since 2023

Strength: analysis-ready calibration and atmospheric correction, open data and developer resources

In one sentence:

XRTech is built for multi-sensor, all-weather industrial operations and mineral fingerprinting via SWIR; Wyvern is built for high-resolution VNIR hyperspectral analysis at scale.

XRTech’s stated urgent pipeline (1.5-hour response, 1-hour delivery for urgent tasks via cloud platform, with standard tasking in 4–7 days) is a major operational advantage for time-sensitive missions.

Wyvern is described as ready-to-task with flexible tasking, but without specific emergency delivery windows in your provided documentation. This does not mean Wyvern is slow; it means procurement teams may need to verify performance SLAs during sales engagement.

XRTech’s non-U.S. positioning can reduce friction for governments and enterprises affected by U.S. export license frameworks. In many regions, procurement delays from ITAR/EAR restrictions can be a real barrier to program continuity. XRTech’s positioning becomes especially relevant across Africa, Asia, and the Middle East.

Wyvern, as a Canadian provider, emphasizes secure commercial access, but different jurisdictions have different trade and compliance realities. The practical point is: if export licensing delays are a known blocker in your procurement environment, XRTech can have an advantage.

XRTech’s volume-based transparency is significant for enterprise buyers. When pricing is structured per km² with clear archive vs tasking tiers, it becomes easier to scale programs and forecast budgets. Check our Pricing!

Wyvern typically handles pricing via consultation, which is common for specialized providers. This approach can still work well, but buyers should anticipate a more tailored quoting process.

This is where many EO programs succeed or fail. Data alone does not deliver outcomes unless it becomes engineering-grade deliverables or operational intelligence.

XRTech’s value-added outputs include:

DOM/DSM/DEM products (with stated vertical RMSE performance in your notes)

InSAR analytics for subsidence monitoring

urban planning and smart lifecycle management outputs

This matters because many clients don’t want to build a remote sensing team from scratch. They want deliverables that plug into engineering, compliance, and operations.

Wyvern focuses on providing calibrated, analysis-ready data products, with an ecosystem designed to help users build their own models and workflows. Their open data program is especially useful for teams experimenting, prototyping, or training ML models before procurement scales.

So the difference is:

XRTech emphasizes engineering-grade products and operational analytics.

Wyvern emphasizes hyperspectral quality and usability for science and development teams.

A multi-sensor solution combining optical, SAR, and hyperspectral for continuous monitoring in real-world conditions.

If your project requires:

30cm-class optical detail for asset identification

SAR for all-weather monitoring and deformation tracking

SWIR + 330-band hyperspectral for mineral and chemical fingerprinting

faster operational response pipelines

drone + satellite fusion for validation and tactical inspection

fewer procurement delays due to export licensing friction

XRTech becomes the better fit for most enterprise, government, mining, energy, and infrastructure programs. Contact us Now!

High spatial resolution hyperspectral VNIR data where the mission depends on detecting subtle VNIR spectral shifts at finer spatial scale.

Wyvern is often a better fit when:

hyperspectral is the main tool, not one layer among many

spatial detail inside hyperspectral is critical (5.3m)

you are building or training your own models

you want research-grade calibration and atmospheric correction

you value an open data program and developer resources

XRTech Group is the stronger choice for large-scale industrial geospatial operations that require optical + SAR + hyperspectral fusion, SWIR mineral fingerprinting with 330 bands, and value-added analytics such as InSAR and engineering-grade terrain outputs. Wyvern is the better choice for projects that prioritize the highest spatial resolution commercial hyperspectral VNIR data (5.3m), research-grade calibration, and hyperspectral-first workflows, especially in agriculture and scientific analysis where VNIR detail matters more than SWIR band depth.

XRTech is better for multi-sensor, all-weather, enterprise operations (optical + SAR + hyperspectral). Wyvern is better for high-resolution hyperspectral VNIR projects where 5.3m spatial detail is the priority.

XRTech is usually better for early mineral targeting because of SWIR coverage (400–2500 nm) and ~330 hyperspectral bands, plus the Khaza’in mineral discovery platform.

Wyvern is often better when hyperspectral spatial detail matters (5.3m) for subtle VNIR crop stress detection, while XRTech is strong for large-area monitoring using frequent optical coverage and crop/yield AI models.

No. Wyvern focuses on hyperspectral only. XRTech provides SAR and InSAR capabilities, enabling monitoring in clouds, at night, and for deformation tracking.

Yes. Many advanced programs use a hybrid approach: Wyvern for high-resolution VNIR hyperspectral insight and XRTech for SWIR mineral fingerprinting, SAR deformation monitoring, and VHR optical asset detail.

Tailings Dam Monitoring: How Advanced Satellite Intelligence Is Transforming Tailings Dam Safety Tailings dams are among the most critical—and high-risk—structures

From Visible Light to Spectral Intelligence in Modern Satellite Remote Sensing Satellite imaging has moved beyond photography. For decades, Earth